Royal Bank of Scotland and Lloyds have announced that are lifting their restriction on their basic bank account holders using ATMS provided by other banks. This means all customers of RBS, Natwest, Lloyds, and TSB should be able to use the whole network by the end of this year. This reverses a controversial decision to which restricted access to ATMs for basic bank account holders.

Royal Bank of Scotland and Lloyds have announced that are lifting their restriction on their basic bank account holders using ATMS provided by other banks. This means all customers of RBS, Natwest, Lloyds, and TSB should be able to use the whole network by the end of this year. This reverses a controversial decision to which restricted access to ATMs for basic bank account holders.

Author Archives: ESAN Admin

Ofgem reports fall in price differences between payment methods

Ofgem has analysed differences in price between different payment methods used by consumers following an information request to suppliers in February 2014. It has found that the gap between prepayment and direct debit has narrowed since 2009. Read more here.

Ofgem has analysed differences in price between different payment methods used by consumers following an information request to suppliers in February 2014. It has found that the gap between prepayment and direct debit has narrowed since 2009. Read more here.

Background

Ofgem rules allow suppliers to charge different prices for different payment methods, but only if the amount reflects the cost of providing those accounts. Some larger suppliers do spread some of the costs of prepayment customers among the whole of their customer base. This is consistent with regulations and guidance, which allow for differences. These result in reduced price differences for vulnerable customers, who often do not have the option of alternative payment methods. Suppliers can also charge the same price regardless of payment method, so they can spread the costs they incur across all customers. However, the majority of consumers pay by direct debit (including half of all fuel-poor households) so any change would mean these consumers would pay more.

Findings

Customers who use prepayment meters are now charged around £80 a year more on average compared with direct debit customers for dual fuel. This is a significant fall as the difference was almost £140 in 2009. Ofgem is satisfied that across the market the price on different payment methods reflects the varying costs suppliers face in providing them. The price difference for quarterly payment compared to direct debit has remained at around £80 since 2009.

E.ON fine

Following an investigation E.ON has agreed to pay £12m to vulnerable customers, after Ofgem found it had broken energy sales rules. E.ON has also committed to compensating any customer that it missold to, including automatic payments to some vulnerable customers.

Following an investigation E.ON has agreed to pay £12m to vulnerable customers, after Ofgem found it had broken energy sales rules. E.ON has also committed to compensating any customer that it missold to, including automatic payments to some vulnerable customers.

Read more from Ofgem here.

The agreed redress package reflects the harm caused by E.ON’s extensive poor sales practices carried out between June 2010 and December 2013.

As part of this package E.ON has agreed to:

•Pay around £35 to 333,000 of their customers who are normally recipients of the Warm Home Discount. This redress package will benefit pensioners, disabled and low income families

•Additionally, make automatic payments to some vulnerable customers who may have been affected by E.ON’s poor sales practices

•Set up a dedicated hotline 0800 0568 497 and compensate all consumers that it missold to

•Write to around 465,000 customers it has identified through its redress work, informing them of how to get in touch to find out whether they were missold to.

Water strategy for Wales

The Welsh Government is asking for views on its water strategy. Read more here. Consultation closes 04/07/2014. Its website says:

The Welsh Government is asking for views on its water strategy. Read more here. Consultation closes 04/07/2014. Its website says:

The Strategy’s aim is to ensure that our water resource is resilient, sustainable and is managed to bring benefits to Wales and its citizens.

This Strategy sets out our long-term policy direction on water. We want to balance the long-term needs of the environment with the need for sufficient, reliable water resources and waste water services available to encourage sustainable growth and job creation.

We are developing a more integrated approach to managing water as part of our natural resource management. This integrated approach will help to promote the coordinated management of water, land and resources. This will enable us to maximise economic and social benefits in a fair way while protecting vital ecosystems and the environment.

Ofgem reports on Time of Use tariffs

As part of the Smarter Markets Programme, Ofgem commissioned the Centre for Sustainable Energy (CSE) to undertake analysis of domestic electricity use patterns and to model the potential distributional impacts of time of use (ToU) tariffs (energy tariffs with different prices at different times).

Ofgem has published CSEs report – see here for more. The tariff modelling undertaken by CSE demonstrates the potential impacts of a ToU tariff on different consumers’ bills. It shows that the types of customers that benefit from ToU tariffs will depend on their current usage as well as how they respond and the types of ToU tariffs on offer.

for more. The tariff modelling undertaken by CSE demonstrates the potential impacts of a ToU tariff on different consumers’ bills. It shows that the types of customers that benefit from ToU tariffs will depend on their current usage as well as how they respond and the types of ToU tariffs on offer.

The publication of this research represents a first step in seeking to understand how ToU tariffs may impact on different customers. Ofgem envisage undertaking further distributional analysis as they make progress towards specific policy decisions as part of the individual projects under the Smarter Markets Programme.

New report on welfare cuts

A new report by Oxfam and the New Policy Institute says the coalition’s welfare cuts have pushed 1.75 million of the UK’s poorest households deeper into poverty, leaving more families struggling to cover food and energy bills.

A new report by Oxfam and the New Policy Institute says the coalition’s welfare cuts have pushed 1.75 million of the UK’s poorest households deeper into poverty, leaving more families struggling to cover food and energy bills.

The report highlights a drop in the overall value of benefits, which rose by less than inflation, as well as changes to housing benefit and council tax support that have forced some families into paying housing costs they were previously deemed too poor to pay.

The report found that 300,000 households have experienced a cut in housing benefit, 920,000 a reduction in council tax support and 480,000 a cut in both.

As a result of these cuts in housing benefit and changes to council tax support, around 1.75 million or the poorest families have seen an absolute cut in their income. Of these, 480,000 families are seeing their benefits being cut twice as they are affected by more than one of the changes. Whether a family is affected and by how much varies based on a range of factors which are largely out of the control of the individual. They depend on council tax band, the cost of local housing, family size and property size. But they all apply irrespective of income. The government needs to instate an ‘absolute minimum’ level of support. It should apply regardless of local authority or tenure and it should be high enough to prevent people from having to walk the breadline

Shelter warns of families on financial knife-edge

Shelter warns that almost 4 million families are living without any safety net.

Shelter warns that almost 4 million families are living without any safety net.

Some 3.8 million families have only enough money to pay their rent or mortgage for a month if they lose their jobs, the housing charity has said.

Shelter, which surveyed 7,500 people, said high housing costs and stagnating wages meant many were living on a financial knife-edge.

The survey

Shelter’s findings were based on a YouGov survey of 7,500 adults who pay rent or a mortgage. It says 44% of working families with children under the age of 18 could be one paycheque away from losing their homes if they became unemployed because they have little or no savings.

Its researchers also found that 29% of families would immediately be unable to afford to pay for their home if they lost their income.

Read more here.

FCA wants financial services firms to stop charging expensive rates for calls

The FCA is concerned that customers are being charged high rates to contact financial services firms and will consult with industry, consumer organisations and consumers to ensure customer calls are more affordable.

The FCA is concerned that customers are being charged high rates to contact financial services firms and will consult with industry, consumer organisations and consumers to ensure customer calls are more affordable.

According to FCA boss Martin Wheatley:

“We want to update our rules so that they best meet your needs as a customer. This means charges for both consumer helplines and complaint lines being capped at the cost of a basic rate call – so the same price as calling your neighbour or a family member on their landline”.

FCA will issue a consultation but wants firms to look at their practices in advance of this.

Consultation

The FCA’s consultation will propose the standardisation of the rules so that charges for consumer help, and complaint, lines are capped at the cost of a basic rate call. In a letter to consumer group, Which?, the FCA said it believed that the introduction of requirements in the Consumer Rights Directive, designed to ensure firms no longer charge a premium for calls, should apply to all financial services firms. The Directive requires firms to offer basic rate numbers for enquiries but at present, this does not apply to financial services firms.

In the same consultation the FCA will also look at a number of proposals to improve complaints handling by financial services firms including looking at complaints reporting and responding to the recommendations of the Parliamentary Commission on Banking Standards. The consultation will be published later this year.

Read more from FCA here.

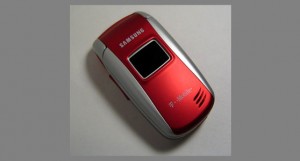

Consumers International publishes agenda for fair mobile services

On 12th March Consumers International (CI) published its Consumer Agenda for Fair Mobile Services ahead of World Consumer Rights Day (WCRD) on Saturday 15 March.

On 12th March Consumers International (CI) published its Consumer Agenda for Fair Mobile Services ahead of World Consumer Rights Day (WCRD) on Saturday 15 March.

In the run up to 15 March, consumer groups will be making one big call on mobile phone service providers to demand better services for the 7 billion mobile users across the globe.

Mobile rip offs are commonplace – from holidaymakers being stung by four figure roaming bills abroad, to customers tricked into paying to receive text messages. With smartphones set to function as a remote control for more and more aspects of our lives, consumer groups believe now is the time to ensure big mobile companies are held to account for unfair, substandard services.

CI’s demands

In consultation with consumer groups around the world, CI has drawn up a Consumer Agenda for Fair Mobile Services, which outlines what the consumer rights movement wants to see changed. This includes demands that telecom companies:

•provide consumers with access to an affordable, reliable service

•provide consumers with fair contracts explained in clear, complete and accessible language

•provide consumers with fair and transparent billing

•provide consumers with security and power over their own information, and

•listen and respond to consumer complaints.

Read more from CI here.

FCA announces new rules for payday lenders

The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014.

The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014.

The rule changes will give consumers additional protection from rogue practices and put the onus on credit providers to ensure that they treat customers fairly at all times.

The biggest changes come for payday lenders and debt management companies, including:

- limiting -overs to two

- restricting (to two) the number of times a firm can seek repayment using a continuous payment authority (CPA)

- a requirement to provide information to customers on how to get free debt advice

- requiring debt management firms to pass on more money to creditors from day one of a debt management plan, and to protect client money

Consumer credit providers will need to ensure that they give customers the right information to make informed choices, that their services meet consumer needs, and that people in difficulty are treated fairly. Read more here.

Thematic review

The FCA have also announced they will start a review of the market as soon as they take over responsibility on 1st April:

Payday lenders and other high cost short term lenders will be the subject of an in-depth thematic review into the way they collect debts and manage borrowers in arrears and forbearance, the Financial Conduct Authority announced on 12th March.

The review will be one of the very first actions the FCA takes as regulator of consumer credit, which begins on 1 April 2014, and reinforces its commitment to protecting consumers – one of its statutory objectives. It is just one part of FCA’s comprehensive and forward looking agenda for tackling poor practice in the high cost short term loan market. Read more here.

Money Advice Trust welcomed the rules saying:

We believe the transfer of regulatory control to the FCA will provide a boost for consumer protections. We especially welcome rules that require customers with high-cost credit in clear financial difficulty to be referred to free debt advice services. Nine out of ten people who speak to a National Debtline adviser say they feel more in control of their finances as a result.

The new two tier regime of regulatory scrutiny should help ensure consumers are protected from some of the worst practices in the industry. Mandatory affordability checks have the potential to prevent much of the harm we see in some credit markets, and so it is important these are rigorously enforced.