The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014.

The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014.

The rule changes will give consumers additional protection from rogue practices and put the onus on credit providers to ensure that they treat customers fairly at all times.

The biggest changes come for payday lenders and debt management companies, including:

- limiting -overs to two

- restricting (to two) the number of times a firm can seek repayment using a continuous payment authority (CPA)

- a requirement to provide information to customers on how to get free debt advice

- requiring debt management firms to pass on more money to creditors from day one of a debt management plan, and to protect client money

Consumer credit providers will need to ensure that they give customers the right information to make informed choices, that their services meet consumer needs, and that people in difficulty are treated fairly. Read more here.

Thematic review

The FCA have also announced they will start a review of the market as soon as they take over responsibility on 1st April:

Payday lenders and other high cost short term lenders will be the subject of an in-depth thematic review into the way they collect debts and manage borrowers in arrears and forbearance, the Financial Conduct Authority announced on 12th March.

The review will be one of the very first actions the FCA takes as regulator of consumer credit, which begins on 1 April 2014, and reinforces its commitment to protecting consumers – one of its statutory objectives. It is just one part of FCA’s comprehensive and forward looking agenda for tackling poor practice in the high cost short term loan market. Read more here.

Money Advice Trust welcomed the rules saying:

We believe the transfer of regulatory control to the FCA will provide a boost for consumer protections. We especially welcome rules that require customers with high-cost credit in clear financial difficulty to be referred to free debt advice services. Nine out of ten people who speak to a National Debtline adviser say they feel more in control of their finances as a result.

The new two tier regime of regulatory scrutiny should help ensure consumers are protected from some of the worst practices in the industry. Mandatory affordability checks have the potential to prevent much of the harm we see in some credit markets, and so it is important these are rigorously enforced.

The FCA said 45,000 customers of the UK’s biggest payday lender would be compensated after it found that letters threatening legal action from non-existent law firms had been sent to customers, in an attempt to boost collections by increasing the pressure on people in debt. In some cases customers had been charged for the letters.

The FCA said 45,000 customers of the UK’s biggest payday lender would be compensated after it found that letters threatening legal action from non-existent law firms had been sent to customers, in an attempt to boost collections by increasing the pressure on people in debt. In some cases customers had been charged for the letters. Shelter warns that almost 4 million families are living without any safety net.

Shelter warns that almost 4 million families are living without any safety net. The FCA is concerned that customers are being charged high rates to contact financial services firms and will consult with industry, consumer organisations and consumers to ensure customer calls are more affordable.

The FCA is concerned that customers are being charged high rates to contact financial services firms and will consult with industry, consumer organisations and consumers to ensure customer calls are more affordable. The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014.

The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014. The review looked at how firms treat customers in arrears or financial difficulty. This is of particular concern as the possibility of interest rate rises looms. The review finds that arrears management in firms has improved since the last review. However, mortgage lenders and administrators need to place greater emphasis on delivering consistently fair outcomes for customers based on their individual circumstances.

The review looked at how firms treat customers in arrears or financial difficulty. This is of particular concern as the possibility of interest rate rises looms. The review finds that arrears management in firms has improved since the last review. However, mortgage lenders and administrators need to place greater emphasis on delivering consistently fair outcomes for customers based on their individual circumstances. Low levels of consumer switching characterise many essential services markets (think current accounts or energy suppliers) and mean that competition alone isn’t sufficient to drive improvements.

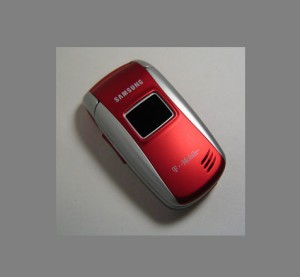

Low levels of consumer switching characterise many essential services markets (think current accounts or energy suppliers) and mean that competition alone isn’t sufficient to drive improvements.  T-Mobile’s service links a pre-paid Visa card to an app on the phone. Cards can be used at ATMs, in shops and to pay bills, and the app can be used to keep track of transactions and balances. Millions of Americans don’t have traditional bank accounts and T-Mobile claim that this service may provide a cheaper alternative to cheque-cashing services and payday lenders. Pre-paid cards are growing in popularity in the US. Read more

T-Mobile’s service links a pre-paid Visa card to an app on the phone. Cards can be used at ATMs, in shops and to pay bills, and the app can be used to keep track of transactions and balances. Millions of Americans don’t have traditional bank accounts and T-Mobile claim that this service may provide a cheaper alternative to cheque-cashing services and payday lenders. Pre-paid cards are growing in popularity in the US. Read more